The crypto market opened today with stories pulling attention in different directions. On one side, Coinbase CEO Brian Armstrong stepped away from backing a Senate draft tied to the crypto bill. On the other hand, the Ethereum price kept doing what it has done for weeks now, moving sideways and testing our patience, even with slight pumps in between, just like what happened yesterday.

Regulatory tension from Coinbase’s withdrawal from the crypto bill is rising just as the Ethereum price continues walking near the same range it has held for more than two months now. While price action feels boring on the surface, history tells us that these quiet periods usually reward holders.

Armstrong didn’t mince words when explaining why Coinbase pulled support. According to him, the current crypto bill draft backed by lawmakers introduces restrictions that could suffocate DeFi and tokenized assets. For Coinbase, supporting a harmful bill simply to “have regulation” isn’t worth the trade-off.

One sticking point is how the crypto bill shifts power away from the CFTC and toward the SEC. Another is language that could effectively kill stablecoin rewards, pushing users back toward traditional banks. From Coinbase’s perspective, such a framework punishes innovation while protecting legacy finance.

After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written.

There are too many issues, including:

– A defacto ban on tokenized equities

– DeFi prohibitions, giving the government unlimited access to your financial…— Brian Armstrong (@brian_armstrong) January 14, 2026

Coinbase, Crypto Bill Debate, and Ethereum Price Reality

The Senate Banking Committee’s decision to delay the bill followed shortly after Armstrong’s criticism, picturing just how fragile the legislative process still is. Coinbase’s stance puts it firmly in line with crypto-native firms asking for smarter rules, even if we need to wait.

I’m actually quite optimistic that we will get to the right outcome with continued effort. We will keep showing up and working with everyone to get there.” – Brian Armstrong on his X post

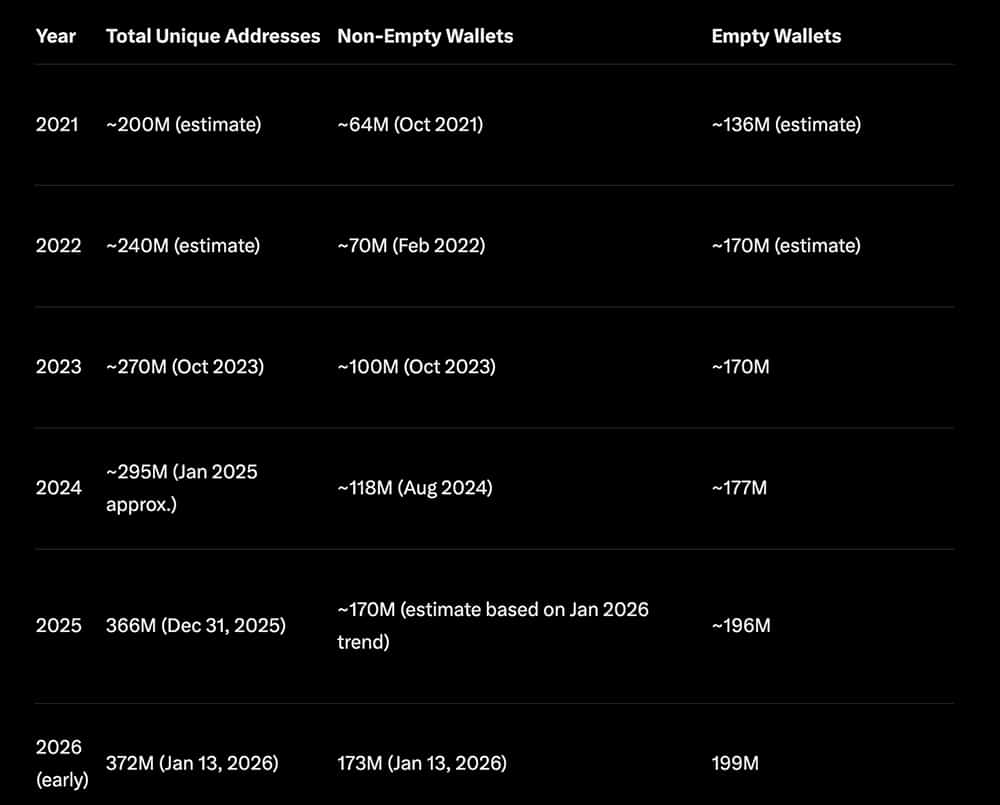

Meanwhile, the Ethereum price barely reacted, especially in a bad way. Despite 62 days of tight range trading between $2,900 and $3,400, Ethereum’s on-chain data keeps improving. New wallet creation recently hit a record, pushing total non-empty wallets to 173 million.

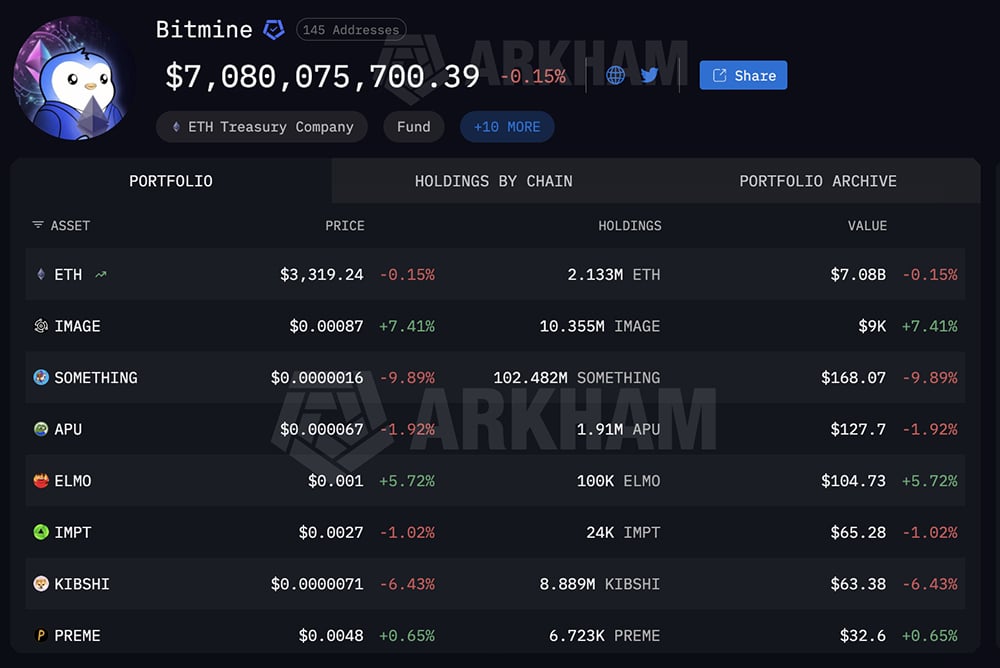

Institutions are clearly watching beyond the short-term Ethereum price chart. Bitmine’s latest move added over 154,000 ETH to its staking pile, from a total holdings of 2,133 million Ethereum worth more than $7 billion at the current price. If Bitmine is bullish, so am I.

(source – Arkham)

DISCOVER: 10+ Next Crypto to 100X In 2026

What Comes Next?

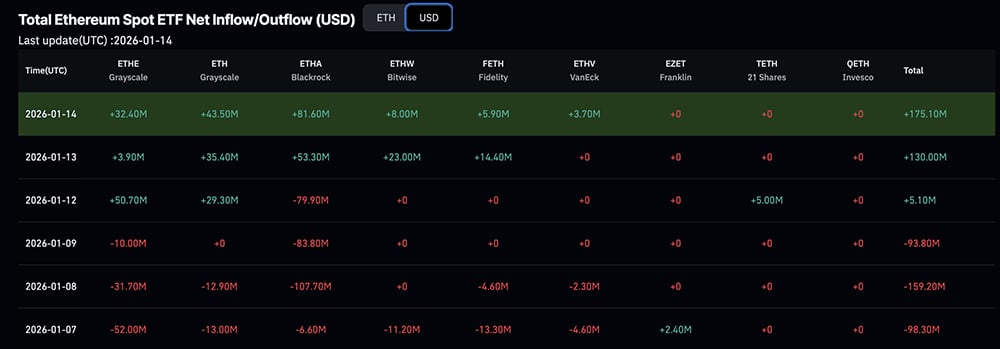

Ethereum still controls over 60% of the stablecoin and tokenization market, a dominance that is yet to be cracked despite hundreds of new competitors. ETF flows went positive again, with over $175 million moving into ETH-focused funds from firms like BlackRock and Fidelity, bringing 3 days of green flows.

(source – Coinglass)

Past cycles show similar Ethereum price consolidations that acted as launchpads for altcoin rallies. If ETH clears resistance at $3,450, momentum could build quickly toward $4,000. Failure there likely means more chop.

Either way, Coinbase is still pushing for a fix from a “flawed” crypto bill, and Ethereum is building strength. Good things come to those who wait.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

DZ Bank Gets MiCA License: Crypto Trading Moves Into German Banks

Germany’s second-largest lender, DZ Bank, secured a MiCA license, clearing a legal hurdle to run regulated crypto services across its cooperative banking network.

MiCA stands for Markets in Crypto-Assets, the EU’s new rulebook for crypto companies. Think of it like a single driver’s license that works across Europe, rather than 27 separate permits, and DZ Bank now holds that license. Zoom out, and this fits into a broader European push to bring crypto into familiar, regulated banking channels.

Latest: DZ Bank takes a giant leap as it secures MiCA license from BaFin! Retail crypto trading is now available in Germany via the newly launched platform, meinKrypto. Embrace the currency of the digital age.

#Cryptocurrency #GermanyDZBank pic.twitter.com/xdR9fqqvCr

— CoinLaw (@coinlaw_io) January 14, 2026

Bitcoin held above $96,000 during the announcement and is up +1.4% overnight, indicating that markets treated this as slow-burn infrastructure news rather than a trigger for a large price spike.

The broader crypto market is holding up extremely well despite rising tensions in Iran and Greenland, with U.S. forces reportedly poised to deploy ground forces in both countries. The combined crypto market cap stands at $3.34 trillion, up +0.5% over the past 24 hours.

Read the full coverage here.

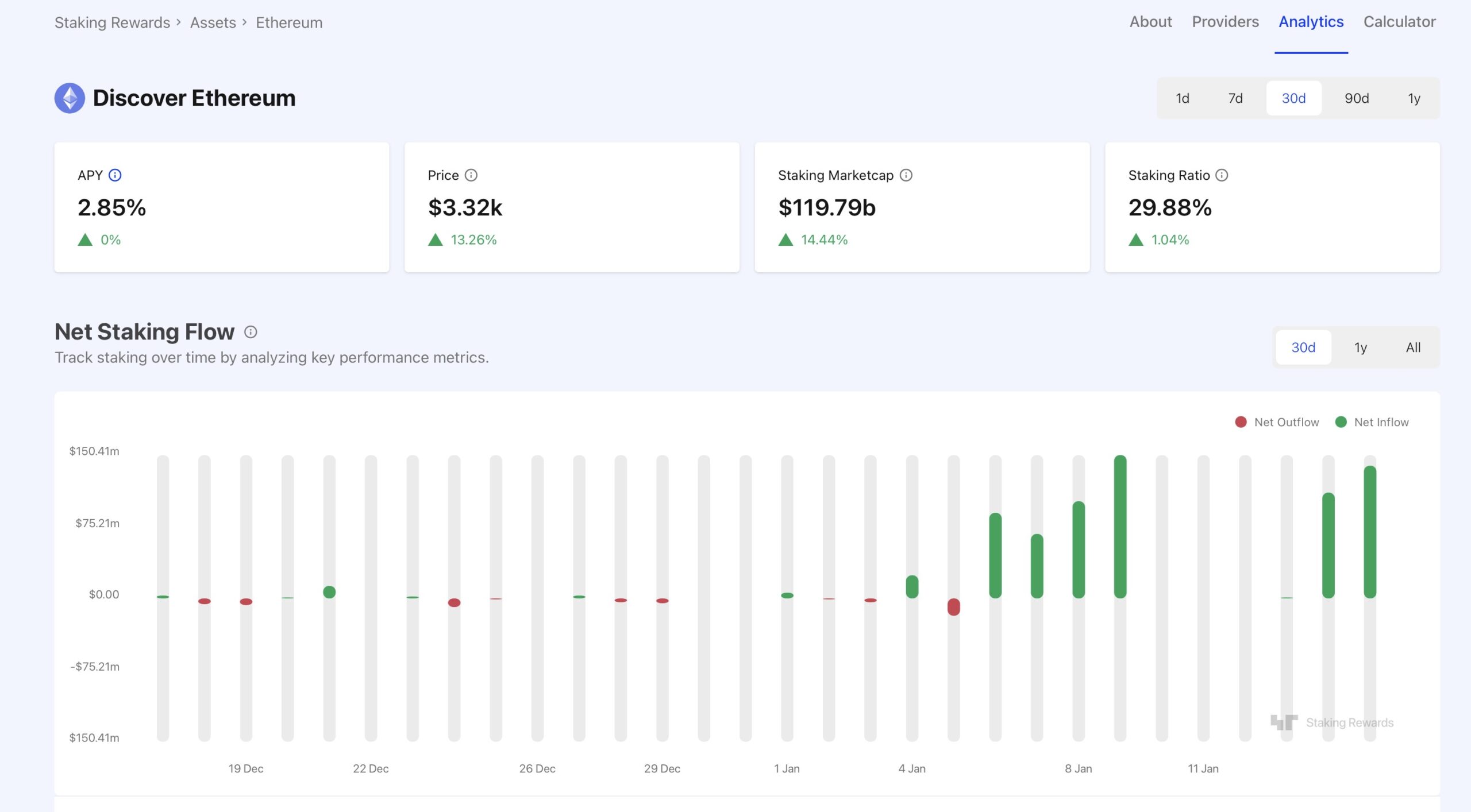

ATH for Ethereum Staking: Nearly 30% of ETH Is Now Locked

Ethereum staking just hit an all-time high, with roughly 36 million ETH, almost 30% of the total supply, now locked up securing the network.

Launched in 2015 by Vitalik Buterin and a team of developers, ETH has evolved from a proof-of-work consensus mechanism, similar to Bitcoin’s mining process, to proof-of-stake following the Merge upgrade in September 2022.

This shift allows participants to secure the network by staking ETH rather than using energy-intensive hardware, making the system more efficient and environmentally sustainable.

Staking is like putting your ETH into a savings account that helps run Ethereum. You lock up ETH, and in return, you earn rewards for helping validate transactions. Right now, that base reward usually sits around 3–5% a year.

One out of every three ETH coins is now locked and unavailable for quick selling. Less liquid supply often reduces selling pressure.

(Source: Staking Rewards)

This milestone reflects growing confidence in the platform’s long-term viability, as stakers contribute to transaction validation while earning rewards. The staked amount equates to over $119.79 billion at current market values.

Read the full story here.

SEC Drops Zcash Probe: Rare Clarity for Privacy Coins, ZEC Crypto To $1,000?

The US Securities and Exchange Commission (SEC) used to terrorize crypto firms under Gary Gensler during the Biden administration so much so that it was pointless for founders to innovate. Lawsuits used to pile up and enforcements remain the order the day. Donald Trump took over, promised to end the nightmare, and he did, and now, the era of regulation through enforcement is over.

Under Trump and Paul Atkins, the current SEC chair, lawsuits against top crypto firms like Coinbase and Uniswap have been settled or withdrawn altogether. Therefore, it came as no surprise when the regulator officially closed its 2023 investigation into Zcash, a privacy-focused cryptocurrency, without recommending enforcement action.

We are pleased to announce that the SEC has concluded its review and informed us that it does not intend to recommend any enforcement action or other changes against Zcash Foundation regarding this matter. https://t.co/zjxfh3mmst

— Zcash Foundation

(@ZcashFoundation) January 14, 2026

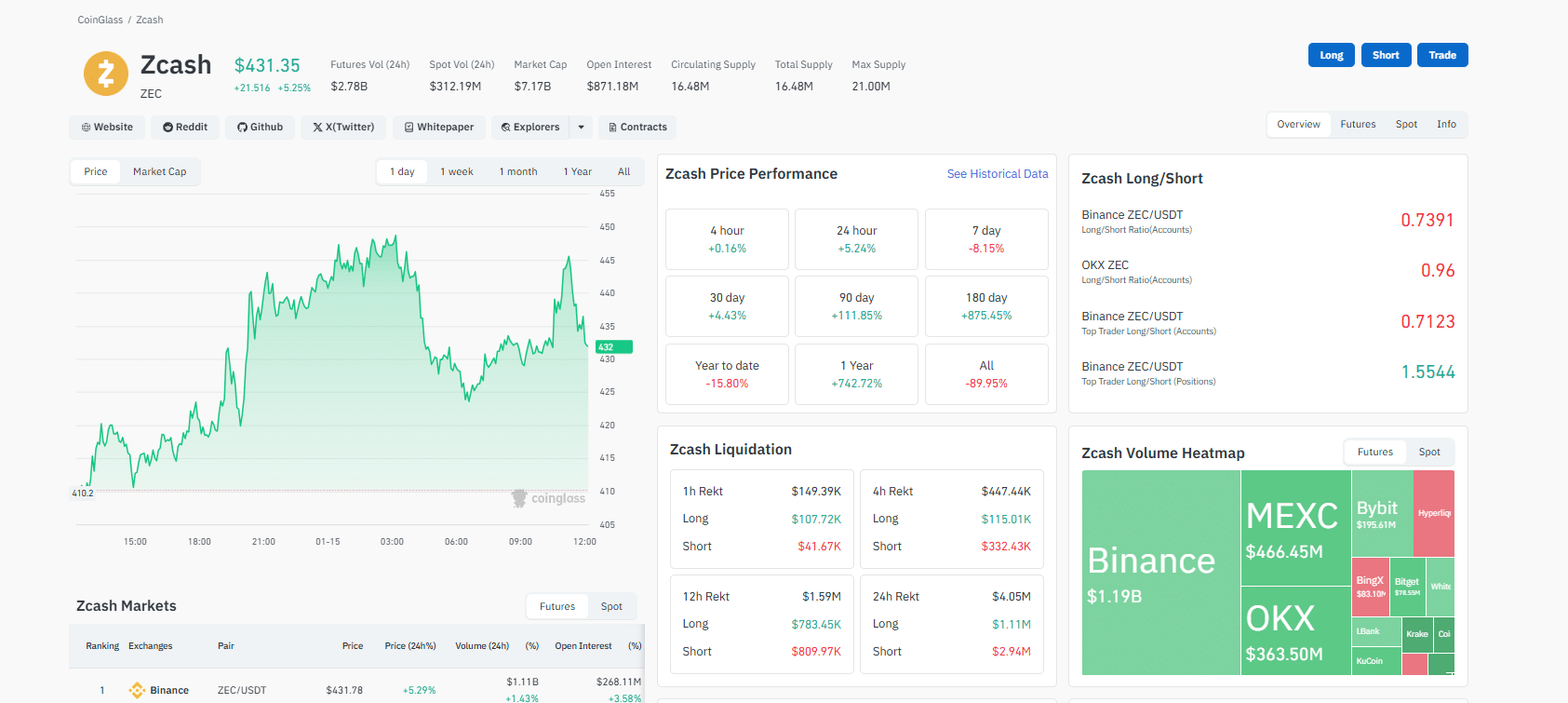

ZEC crypto, which is undoubtedly one of the top cryptos to consider in this cycle, reacted calmly, holding its recent range after months of pressure tied to regulatory fear. ZEC USDT is firm above $400, and remains one of the top performers, standing out from the thousands of coins. On Coinglass, nearly $3M of ZEC crypto shorts were also liquidated prices briefly jumped.

(Source: Coinglass)

Read our full coverage here.

Ethereum Is Catching Up to Bitcoin: Here’s Why 2026 is Huge for ETH USD

Ethereum is showing early signs that it may finally outperform Bitcoin in 2026, following a lackluster two years. According to on-chain and institutional data, Ethereum is growing rapidly. ETH USD is up +5.8% over the past seven days and is trading at around $3,300 today, while Bitcoin is hovering around $96,000.

However, the price gap tells only part of the story. The bigger trend is a slow shift in investor attention away from Bitcoin-only bets and toward Ethereum’s broader utility. Institutions are rotating from BTC to ETH due to its yield-bearing nature, with around 2.8% APY on offer for staking Ethereum, while Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

has no native staking yield.

Although 2026 has gotten off to a strong start for both BTC and ETH, when Bitcoin cools after a strong run, capital often looks for the next asset to pop. Right now, Ethereum represents the best altcoin play.

The macro backdrop supports this idea. Bitcoin ETFs stabilized in 2025, while Ethereum entered 2026 with major network upgrades, rising usage, and growing institutional interest.

Read the full story here.

The post Crypto Market News Today, January 15: Coinbase CEO Stops ‘The Written’ Crypto Bill Support as Ethereum Price Sideways in 2 Months | Altcoin Season Coming? appeared first on 99Bitcoins.