Ronin, the blockchain behind the hit game Axie Infinity, has announced a new plan to strengthen its token economy through smart moves that have surged the RON price. Is it a good time to buy RON? Let’s dive in.

The Sky Mavis-built network said on Sept. 21 that it will begin buying RON from the open market starting Sept. 29.

Over about a month, the team will convert its Treasury’s 890 ETH and 650,000 USDC, roughly $4.5-$5M, into RON. At current prices, that equals about 1.3% of circulating supply.

All purchases will be executed on-chain with third-party market makers, and the team stressed that no RON sales are planned.

RON Buybacks: Unleashing the Ronin Treasury

Ronin’s sleeping giant is waking up.

Over the past four years, the Ronin Treasury has accumulated a massive trove of tokens.

This silent stockpile has been growing in the shadows for too long.

We’re ready to unleash the beast.

On… pic.twitter.com/CLVSAkdDDH

— Ronin (@Ronin_Network) September 21, 2025

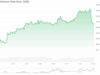

The announcement has lifted market sentiment. RON traded near $0.53 in the past 24 hours, with daily volume topping $29M, up sharply from prior levels.

CoinMarketCap data showed the token up around +8% in the same period, while it recorded a 24-hour range between $0.487 and $0.541.

The move aligns with broader changes in Ronin’s tokenomics. Earlier this year, the March 17 “Cerastes” upgrade introduced EIP-1559–style gas mechanics, which burn a base portion of fees while channeling another share into the Treasury.

Messari estimated that this setup could accrue as much as 3M RON per year with steady usage, about 0.3% of total supply. Together, fees, burns, and buybacks now create dual deflationary pressure.

Ronin framed the buybacks as part of its “homecoming” to Ethereum as a layer-2 chain and a way to align holders and builders around long-term growth.

The update follows a year of infrastructure expansion, including permissionless deployment and new DeFi initiatives.

Buybacks will begin Sept. 29 and run for about a month, with the actual impact depending on price levels, slippage, and validator-approved schedules.

Meanwhile, the fee-burning model means the network’s growth through gas usage, game launches, or DeFi activity will directly influence how strong the deflationary effect becomes.

For now, the combination of on-chain buybacks and structural burns has stoked debate among traders: Is this the setup that makes RON the best crypto to buy?

EXPLORE: Best Meme Coin ICOs to Invest in September

RON Price Prediction: What Makes Ronin’s $4.5M Buyback Plan Important for RON Token Holders?

Crypto analyst Hydraze says tokens that recycle revenue into their supply have led this cycle.

We’ve seen how well revenue generating tokens have done this cycle with teams that put that revenue back into the token.

Ronin have amassed quite a treasury & from Sept 29th will start putting that ~$4.5M into $RON token buy backs.

I started accumulating around $0.48 & the… pic.twitter.com/UQiPnSNgg2

— Hydraze

(@Hydraze420) September 21, 2025

Ronin fits that theme. The blockchain gaming network plans to start about $4.5M in RON buybacks on September 29.

Hydraze said he began buying near $0.48 and expects “the needle to start moving soon,” calling it a comfortable setup.

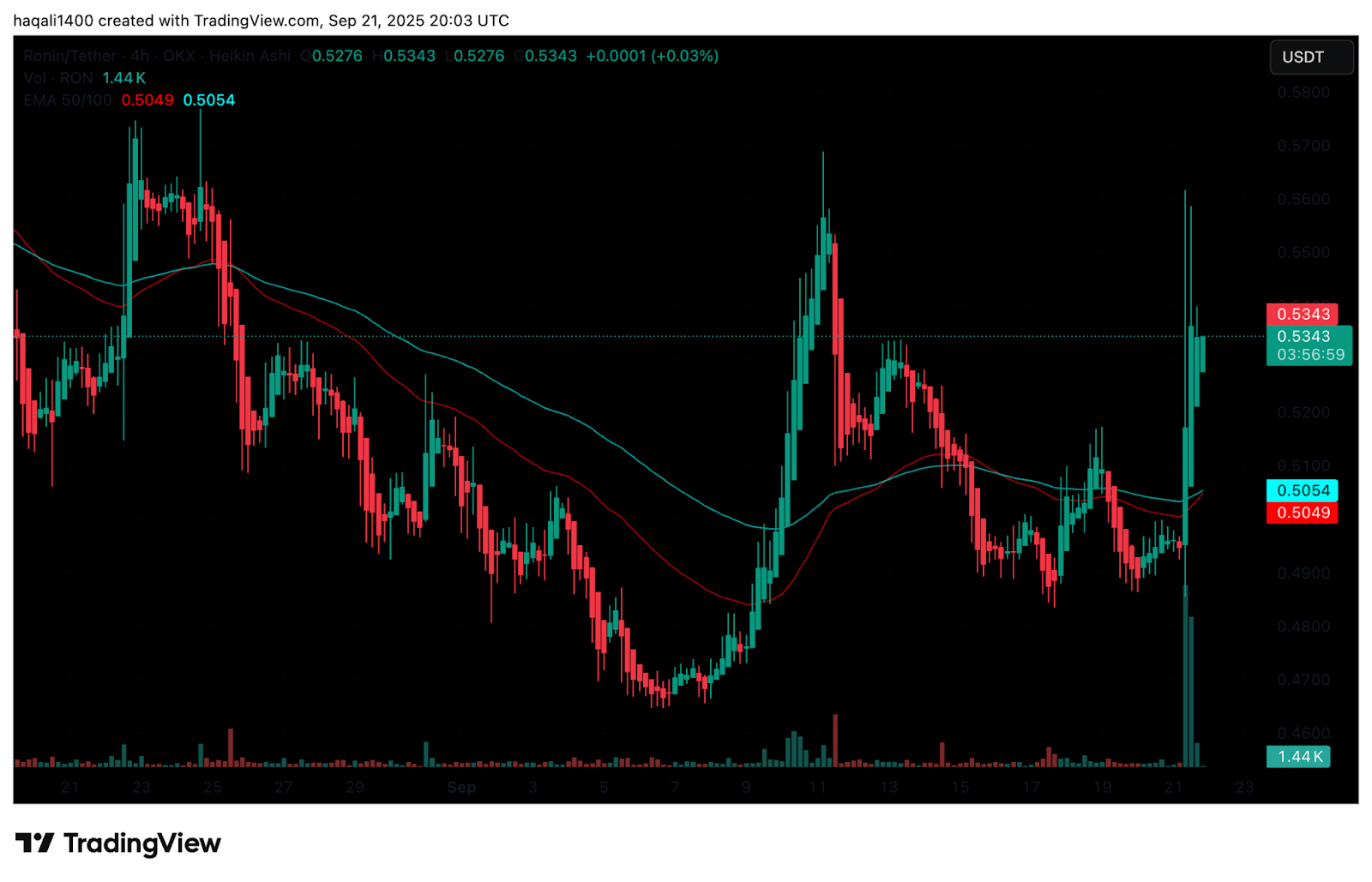

Price action supports this view. According to Tradingview data, RON rebounded cleanly from the $0.47-$0.48 area, right where Hydraze placed his entry.

(Source: RON USDT, TradingView)

(Source: RON USDT, TradingView)

The bounce came with a clear volume pickup, a sign of fresh participation rather than a thin move.

Technically, buyers have retaken key lines. RON is back above the 50-EMA ($0.505) and 100-EMA ($0.504), which had capped rallies earlier in September.

After an intraday push above $0.56, the price consolidates at over $0.53.

Holding that $0.52-$0.53 shelf would keep momentum on the bulls’ side and set up a $0.57-$0.58 retest.

The backdrop is still volatile. Mid-September rallies met quick profit-taking. Even so, the latest swing higher leaves a pattern of higher lows, which is constructive if volume stays firm.

Green candles printing on rising volume add to that case.

The near-term catalyst is the buyback start date. If treasury support arrives as planned and price holds the 50-EMA, traders will look to $0.60 as the next psychological test. Lose the 50-EMA, and pressure can quickly shift back toward $0.50.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post RON Crypto to Go Parabolic as Ronin Reveals Token Burns: Time to Buy? appeared first on 99Bitcoins.