Bitcoin’s late-January plunge triggered $2 billion in liquidations, broke crucial supports, and left nearly half of the supply underwater, Galaxy found.

Bitcoin (BTC) has tried to recover above $78,000 after sustaining devastating losses over the weekend, but the bears took the upper hand and pushed the price back down. Galaxy Digital research head Alex Thorn said recent on-chain data and market structure suggest continued downside risk for BTC.

The researcher cited weak momentum, macroeconomic uncertainty, and missing catalysts, indicating further pain rather than relief.

Downtrend Firms Up

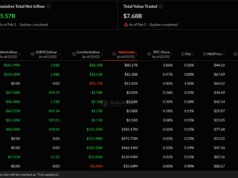

In the latest research note, Thorn pointed to the sharp sell-off late last month, during which Bitcoin fell 15% between January 28 and 31, while the decline accelerated into the weekend. On Saturday alone, a roughly 10% drop triggered one of the largest liquidation events on record. More than $2 billion in long positions were liquidated across futures trading venues.

During the move, BTC fell as low as $75,644 on Coinbase, and slipped as much as 10% below the average cost basis of US spot Bitcoin ETFs, estimated at around $84,000. At one point, the crypto asset also briefly traded below Strategy’s reported average cost basis of $76,037 and came close to its one-year low of $74,420, set during the April 2025 “Tariff Tantrum.”

Thorn stated that 46% of Bitcoin’s circulating supply is now underwater, which means that those coins last moved on-chain at higher prices, and that Bitcoin’s January close marked four consecutive red monthly candles for the first time since 2018. According to the note, with the exception of 2017, the asset has not previously experienced a roughly 40% drawdown from an all-time high without extending to a decline of 50% or more within three months. This would imply that prices are closer to $63,000 based on the current cycle.

The Galaxy researcher also flagged a significant gap in on-chain ownership between roughly $82,000 and $70,000, which indicates limited demand in that range and increases the likelihood of a further test lower.

Its analysis places Bitcoin’s realized price near $56,000 and the 200-week moving average around $58,000, levels that rise gradually as long as spot prices remain above them.

You may also like:

The note said there is little evidence of significant accumulation by whales or long-term holders, though long-term holder profit-taking has begun to ease. Thorn outlined that potential catalysts remain difficult to identify, while narratives have also worked against Bitcoin as it has failed to trade in line with precious metals like gold and silver during a period of increased macro and geopolitical uncertainty.

While the passage of US crypto market structure legislation, known as the CLARITY Act, could act as an external catalyst, Galaxy said the odds of passage have diminished in recent weeks and that any positive impact may benefit altcoins more than Bitcoin.

These factors combined raise the chance that Bitcoin drifts toward the lower end of the $70,000 range and potentially tests the realized price and 200-week moving average in the high-$50,000 area over the coming weeks or months. Interestingly, these levels have historically represented cycle bottoms and strong long-term entry points.

BTC Bottom May Be Deeper

Crypto analyst Doctor Profit recently lowered his expectations for BTC’s cycle bottom after the price decline. He said the sell-off and loss of important technical support levels have changed the market outlook.

As a result, he revised his projected bottom to a lower range between $54,000 and $44,000, down from his earlier estimate of $50,000 to $60,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).